Buying your basic residence is a giant decision. However, discovering much more about the procedure will help you to feel prepared while increasing your believe shifting. Below is a listing of earliest-big date house buyers’ faqs. Read on to discover more regarding the latest pre-acceptance processes, to make a deal, and you will escrow.

Pre-Approval Processes

What is pre-recognition? Pre-acceptance is actually a way about how to establish the creditworthiness before to shop for a house. This is an essential first faltering step having very first-time homebuyers. It assists your find out how much you could potentially borrow. Using this count, you’re going to be motivated to begin with domestic google search of the understanding your price variety. To receive pre-approval, you need to consult with a lender to begin with the method. This can be an excellent opportunity to explore financing solutions, and you may cost management requires, and you will choose possible credit items.

Whenever do i need to begin new pre-recognition process? If you have good credit and are generally positive about your capability to qualify for a loan, it’s best to consult a lender when you find yourself in a position first off household google search. Pre-approval letters are typically valid to have 60 in order to ninety days, it is therefore better to bring that it into consideration since you browse to have a property. Given that pre-approval ends, you are going to need to fill in updated records as part of a the fresh new mortgage app.

When you yourself have second thoughts regarding the borrowing and you will capability to get that loan, consider consulting with a loan provider approximately a-year upfront household hunting. This may give you time for you to identify any possible borrowing products and take step to handle all of them. And, you’ll have more time to keep getting a more impressive downpayment, that can alter your possibility of being qualified for a loan.

Exactly what information is needed in the pre-recognition techniques? The answer to that it matter may vary a little according to financial and each loan seeker’s problem. Normally, first-day homebuyers need certainly to offer an overall total economic picture with evidence of a position, borrowing advice, earnings, property, existing financing, or any other practical character records. Request this useful pre-recognition checklist for additional information on what you will need to score started.

Shortly after going through the pre-recognition procedure, Windermere Kingston Agent/Realtor, Michelle Plan suggests home buyers can be found in fully underwritten. She teaches you, You might be almost because the aggressive since a complete bucks offer, that’s important in the current timely-moving seller’s field. View their complete video less than to learn more.

Lenders and you may Mortgage brokers

How can i come across personal loans online New Jersey a lender? When it comes to finding a lender, it’s best to research thoroughly. There are various choice together with on the web lenders, home loans, and you may regional finance companies. In the Windermere, i encourage working with a community lender to better establish upwards for achievement. You will find some advantages of choosing a community bank you simply cannot pick in other places such as a customized feel and you can deep local community education.

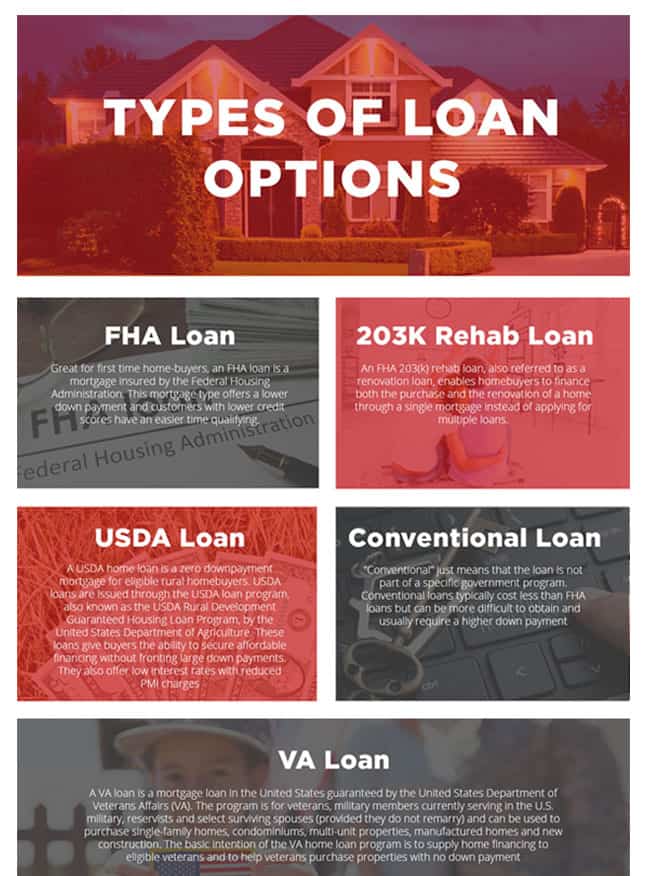

What kind of mortgage should i score? Old-fashioned finance would be the most typical type of mortgage provided in order to home buyers by individual lenders. Both typical old-fashioned money is actually 15-seasons and you will 29-seasons fixed-price mortgages. A good fifteen-year mortgage setting you are able to pay less desire towards financing overall. However, it needs a top payment per month. A thirty-12 months financing contains the benefit of a lowered payment, however, will ultimately pricing property client additionally a lengthier time period. Just in case you you should never qualify for conventional funds, government-backed finance could well be advisable. Learn more about the mortgage options available to better understand the best choice to you.

To make a deal

How can i make an offer? This is where with an excellent realtor is important. Your representative will work to you so you can smartly pastime a deal which will take into consideration a number of activities including your finances in addition to regional market to verify it is competitive. Including, you will need to have your pre-recognition letter willing to make sure the provider understands the provide are backed by a lender. Whether your give is underneath the limitation amount borrowed you may be approved for, its wise to focus on your own financial to obtain a personalized page with the bring count. Or even, a supplier may see the larger amount on the page and you will inquire about a lot more. Finally, make sure your advance payment is prepared. In the event the everything you goes smoothly, you really need to have this in position so you can seal the deal.